Make an Enquiry About This Property

Ref: 739002

Property marketed by Lavanda Real Estate SL

Your Name:

Email Address:

Telephone Nº:

By checking this box, we will pass your query on to up to five other Estate Agents who have similar properties to this.

How can we help you?:

New Development: Prices from 2,950,000 € to 2,950,000 €. [Beds: 5 - 5] [Baths: 5 - 5] [Built size: 504.00 m2 - 504.00 m2]

Characterised by the visual strength of its organic forms and spectacular sea views, this home stands as the villa of nature. Dressed in white with touches of wood that go hand in hand to create a suggestive visual play of textures.

Characterised by the visual strength of its organic forms and spectacular sea views, this home stands as the villa of nature. Dressed in white with touches of wood that go hand in hand to create a suggestive visual play of textures.

Property Features

- 5 bedrooms

- 5 bathrooms

- 504m² Build size

- 1,164m² Plot size

- Swimming Pool

Costing Breakdown

Standard form of payment

Reservation deposit

3,000€

Remainder of deposit to 10%

292,000€

Final Payment of 90% on completion

2,655,000€

Property Purchase Expenses

Property price

2,950,000€

Transfer tax 10%

295,000€

Notary fees (approx)

600€

Land registry fees (approx)

600€

Legal fees (approx)

1,500€

* Transfer tax is based on the sale value or the cadastral value whichever is the highest.

** The information above is displayed as a guide only.

Mortgage Calculator

Similar Properties

Spanish Property News & Updates by Spain Property Portal.com

In Spain, two primary taxes are associated with property purchases: IVA (Value Added Tax) and ITP (Property Transfer Tax). IVA, typically applicable to new constructions, stands at 10% of the property's value. On the other hand, ITP, levied on resale properties, varies between regions but generally ranges from 6% to 10%.

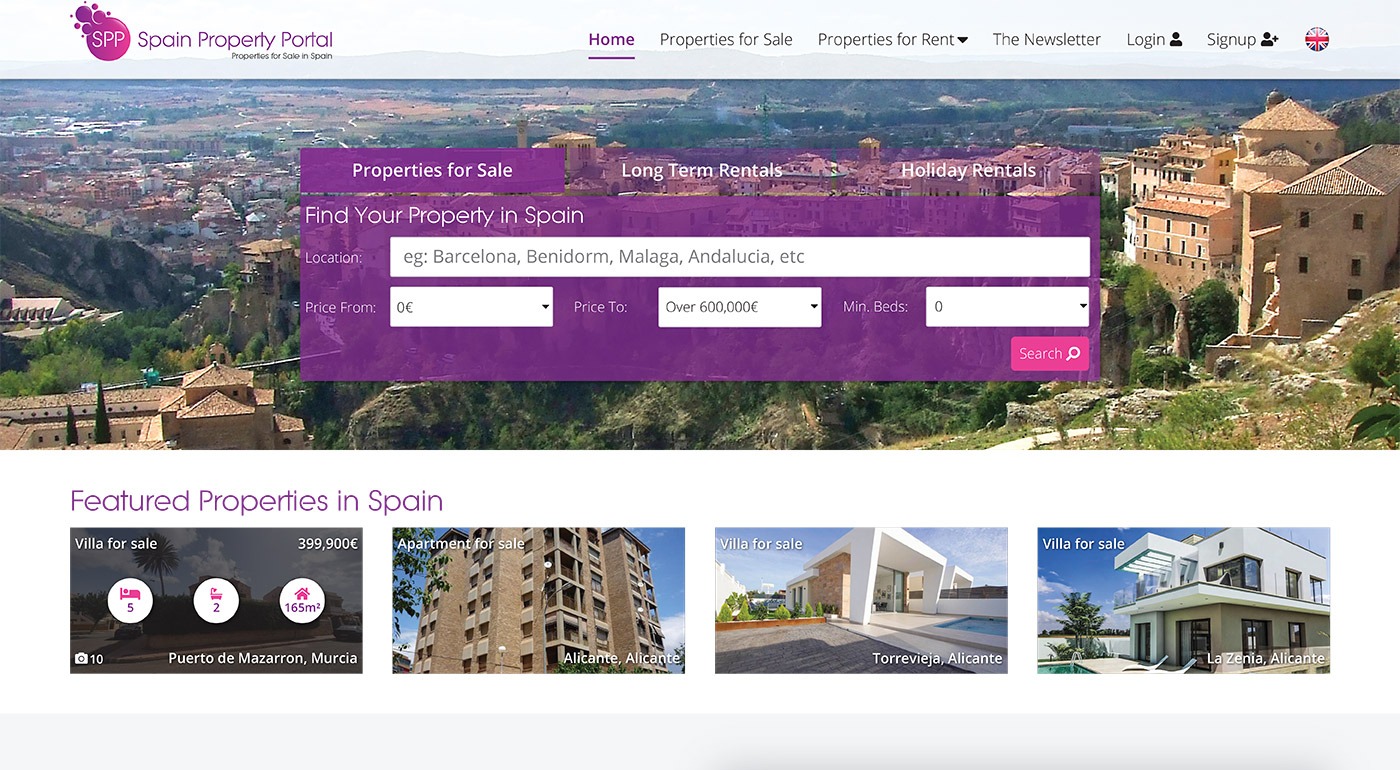

Spain Property Portal is an online platform that has revolutionized the way people buy and sell real estate in Spain.

In Spain, mortgages, known as "hipotecas," are common, and the market has seen significant growth and evolution.