Filters

5,155 Results

Order by:

339,000€

- 2

- 2

- Pool

- 79m²

339,000€

- 3

- 2

- Pool

- 102m²

339,000€

- 3

- 2

- Pool

- 102m²

339,000€

- 2

- 2

- Pool

- 46m²

338,500€

- 2

- 2

- Pool

- 85m²

- 500m²

338,500€

- 2

- 2

- Pool

- 85m²

- 500m²

338,500€

- 2

- 2

- Pool

- 85m²

- 500m²

337,500€

- 5

- 3

- Pool

- 202m²

- 420m²

PreviousProperties priced between 348,500€ & 339,000€1Properties priced between 6,950,000€ & 2,750,000€1Properties priced between 6,950,000€ & 2,750,000€39Properties priced between 369,950€ & 360,000€40Properties priced between 360,000€ & 355,000€41Properties priced between 355,000€ & 349,000€42Properties priced between 348,500€ & 339,000€42Properties priced between 348,500€ & 339,000€43Properties priced between 339,000€ & 335,000€44Properties priced between 335,000€ & 333,480€44Properties priced between 335,000€ & 333,480€45Properties priced between 330,000€ & 325,900€46Properties priced between 324,900€ & 315,000€47Properties priced between 315,000€ & 308,500€430Properties priced between 11,000€ & 8,000€430Properties priced between 11,000€ & 8,000€Next Properties priced between 335,000€ & 333,480€

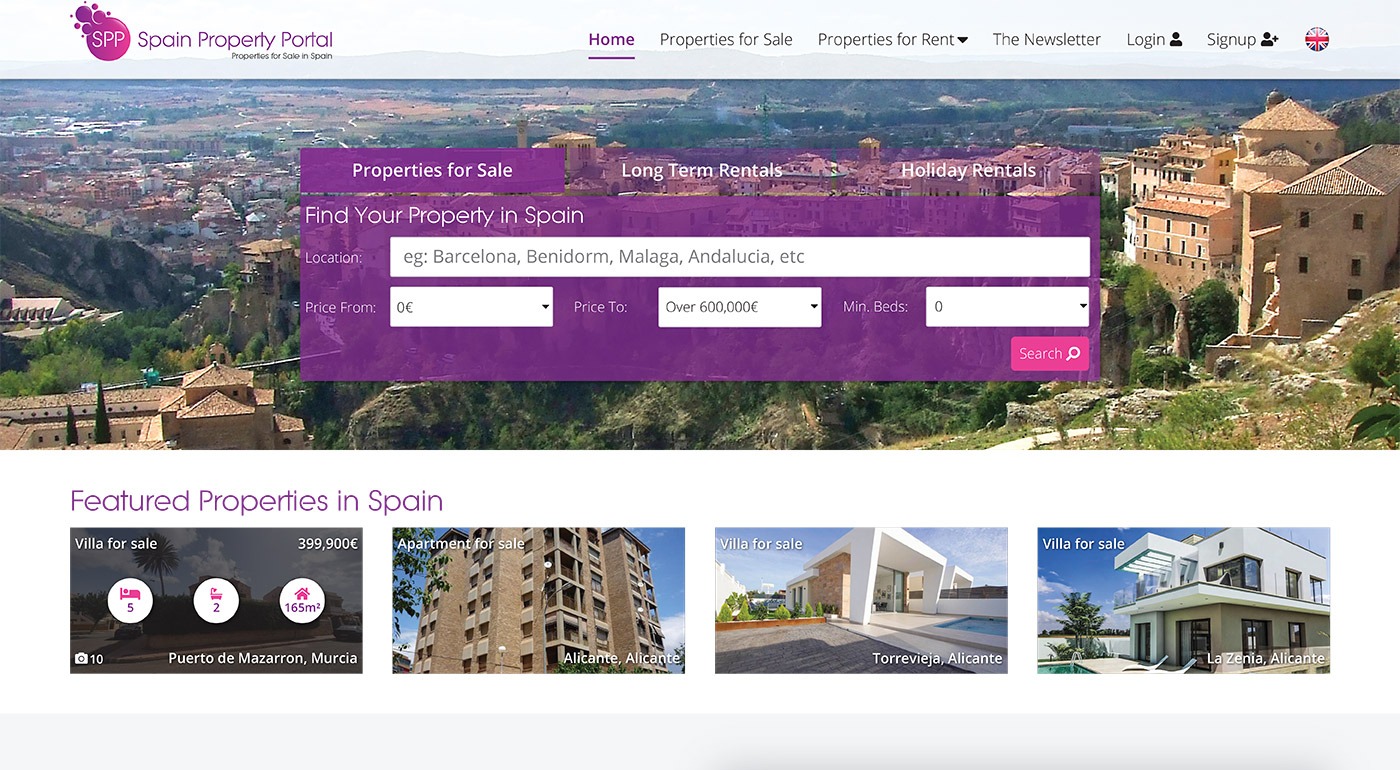

Spanish Property News & Updates by Spain Property Portal.com

In Spain, two primary taxes are associated with property purchases: IVA (Value Added Tax) and ITP (Property Transfer Tax). IVA, typically applicable to new constructions, stands at 10% of the property's value. On the other hand, ITP, levied on resale properties, varies between regions but generally ranges from 6% to 10%.

Spain Property Portal is an online platform that has revolutionized the way people buy and sell real estate in Spain.

In Spain, mortgages, known as "hipotecas," are common, and the market has seen significant growth and evolution.