Filter

77 Resultat

Sortera efter:

TidigareFastigheter prissatta mellan 315.500€ & 435.000€1Fastigheter prissatta mellan 80.000€ & 134.500€1Fastigheter prissatta mellan 80.000€ & 134.500€2Fastigheter prissatta mellan 153.760€ & 190.000€3Fastigheter prissatta mellan 194.580€ & 250.000€4Fastigheter prissatta mellan 260.000€ & 309.950€5Fastigheter prissatta mellan 315.500€ & 435.000€5Fastigheter prissatta mellan 315.500€ & 435.000€6Fastigheter prissatta mellan 445.000€ & 695.000€7Fastigheter prissatta mellan 840.000€ & 1.615.000€7Fastigheter prissatta mellan 840.000€ & 1.615.000€Nästa Fastigheter prissatta mellan 840.000€ & 1.615.000€

Spanska fastighetsnyheter och uppdateringar av Spain Property Portal.com

In Spain, two primary taxes are associated with property purchases: IVA (Value Added Tax) and ITP (Property Transfer Tax). IVA, typically applicable to new constructions, stands at 10% of the property's value. On the other hand, ITP, levied on resale properties, varies between regions but generally ranges from 6% to 10%.

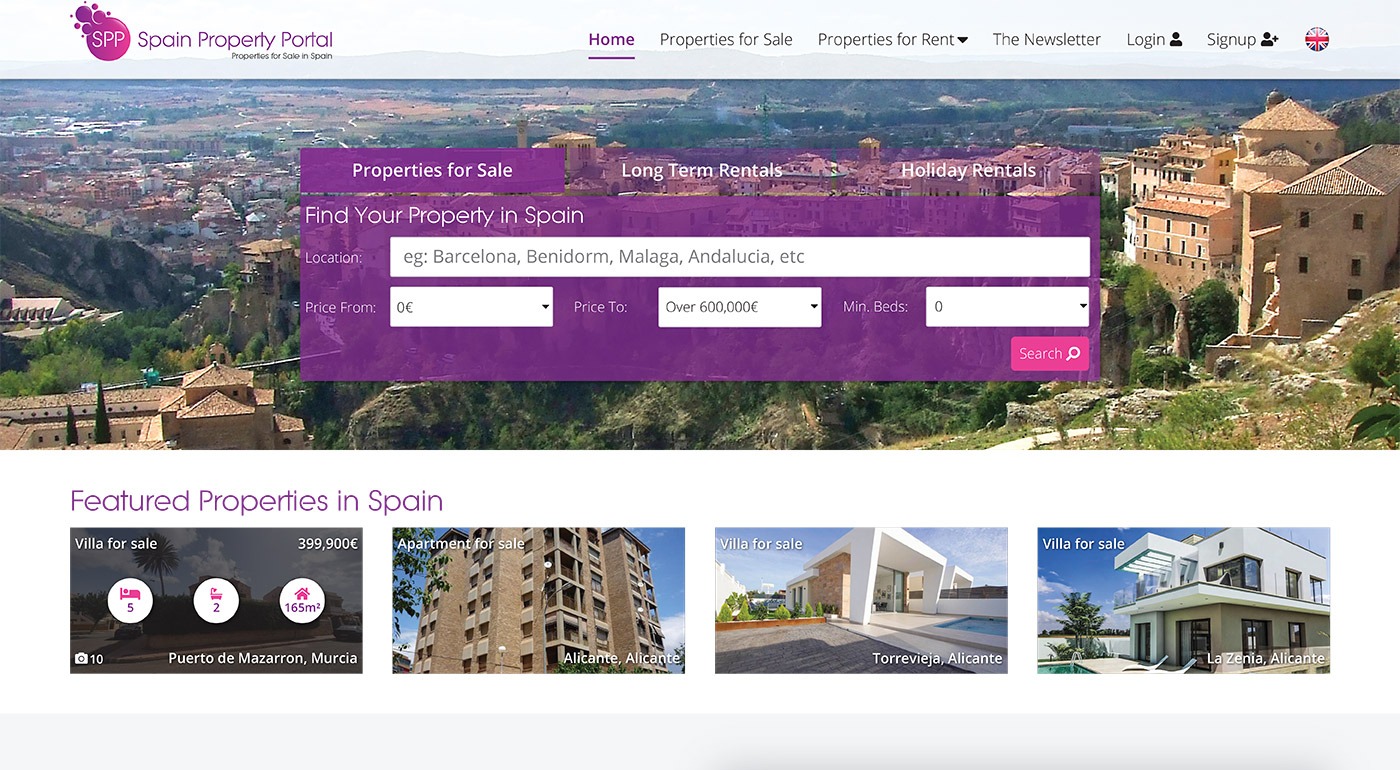

Spain Property Portal is an online platform that has revolutionized the way people buy and sell real estate in Spain.

In Spain, mortgages, known as "hipotecas," are common, and the market has seen significant growth and evolution.